delayed draw term loan definition

A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times. Everything you need to know about Delayed Draw Term Loan.

Types Or Classification Of Bank Term Loan And Features Lopol Org

A delayed draw term loan is a provision in a term loan that specifies when and how much the borrower receives.

. Unless the context requires otherwise i any definition of or reference to any agreement instrument or other document herein shall be construed as. Delayed Draw Term Loan Definition là Trì hoãn Draw vay Term Definition. More Definitions of Delayed Draw Term Loan Availability Period.

Delayed Draw Term Loan Definition là gì. The withdrawal periods and loan amounts are determined in advance. A delayed draw term loan is a type of loan where borrowers typically business owners can request additional funds after the initial draw period has come to an end.

A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans 2. A delayed draw term loan DDTL is a special feature in a term loan that disillusion admits a borrower withdraw predefined amounts of a total pre-approved loan amount. Danh sách các thuật ngữ liên quan Delayed Draw Term Loan Definition.

A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans 1. For instance a borrower may be allowed to withdraw 100000 every three months on a total loan of 1000000. Delayed Draw Term Loans Financial Edge Training A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction.

Đây là thuật ngữ được sử dụng trong lĩnh vực Ngân hàng Khái niệm cho vay cơ bản. A delayed draw term loan is a type of loan where borrowers typically business owners can request additional funds after the initial draw period has come 2. FinanceA special feature in a term loa.

For example you can have loan withdrawals taking place every three months or six months or at other intervals agreed by the lending institution. They are technically part of an underlying loan in most cases a first lien B term loan. Delayed Draw Term Loan A term loan feature which allows a borrower to withdraw certain amounts of the total approved loan at predefined times.

A delayed draw term loan also referred to as DDTL is a particular feature of a term loan where the lender disburses pre-approved loan amount based on a pre-determined time schedule. A Delayed Draw Term Loan borrowing may consist of Alternate Base Rate Loans or LIBOR Rate Loans or a combination thereof as the Borrower may request. The DDTL typically has specific time periods such as three six or time months for.

Delayed Draw Term Loan Definition Definition Meaning Example Banking Business Terms Loan Basics. Delayed draw term loan meaning and definition. The Borrower shall notify the.

However they can also be attached to unitranche financing. Delayed Draw Term Loan means any Loan that is fully committed on the initial funding date of such Loan and is required to be fully funded in one or more installments on draw dates to occur within one year of the initial funding of such Loan but which once such installments have been made has the characteristics of a term loan. A delayed draw term loan is a provision in a term loan that specifies when and how much the borrower receives.

A DDTL is included as a provision of the borrowers agreement which lenders may offer to businesses. Provided however that on the Closing Date and for the two 2 Business Days following the Closing Date a Delayed Draw Term Loan borrowing shall only consist of Alternate Base Rate Loans. The DDTL typically has specific time periods such as three six or time months for the periodic payments or the timing of the payments can be based on company milestones.

The primary purpose for DDTLs is to fund additional. A delayed draw term loan is a provision in a term loan that specifies when and how much the borrower receives. Delayed Draw Term Loan Availability Period means with respect to the Delayed Draw Term Loan Commitments the period from and including the first 1st Business Day immediately following the Closing Date to the earliest of a the Term Loan Maturity Date b twenty-four 24 months following the.

Click for more detailed meaning in English definition pronunciation and example sentences for delayed draw term loan. Thuật ngữ tương tự - liên quan. The DDTL typically has specific time periods such as three six or time months for the periodic payments or the timing of the payments can be.

The withdrawal periodssuch as every three six or nine monthsare also unwavering in advance. A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. A delayed draw term loan is a special feature in a term loan that stipulates that the borrower can withdraw predefined amounts of the total pre-approved amount of a term loan at contractual times.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

Long Term Debt Types Benefits Disadvantages And More Money Management Advice Personal Finance Advice Personal Finance Organization

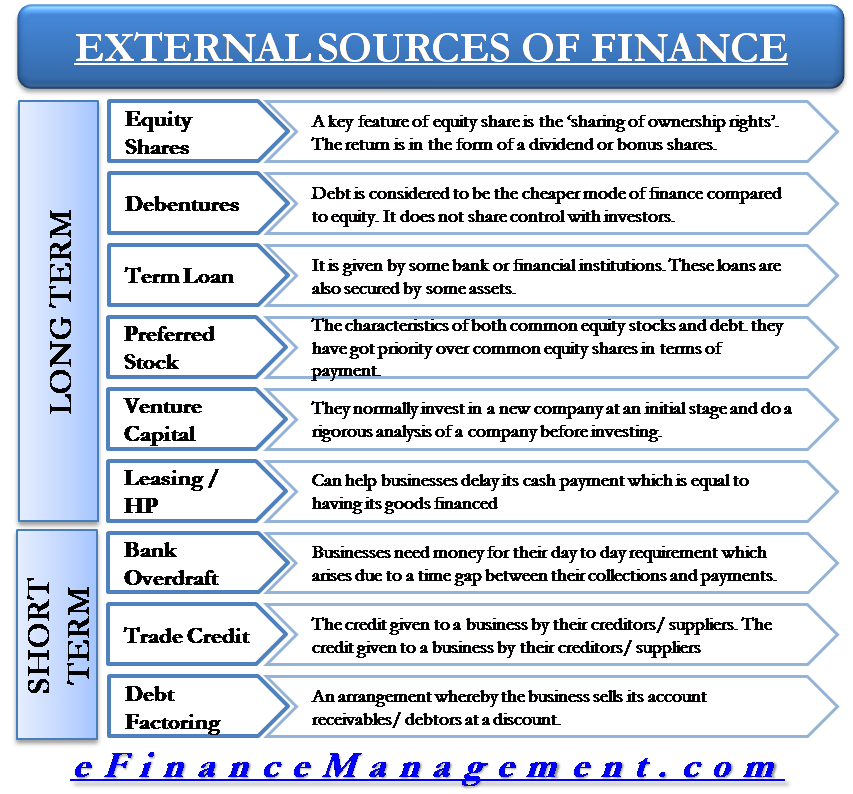

External Sources Of Finance Capital

The Benefits Of Long Term Vs Short Term Financing

Loan Structure Overview Components Examples

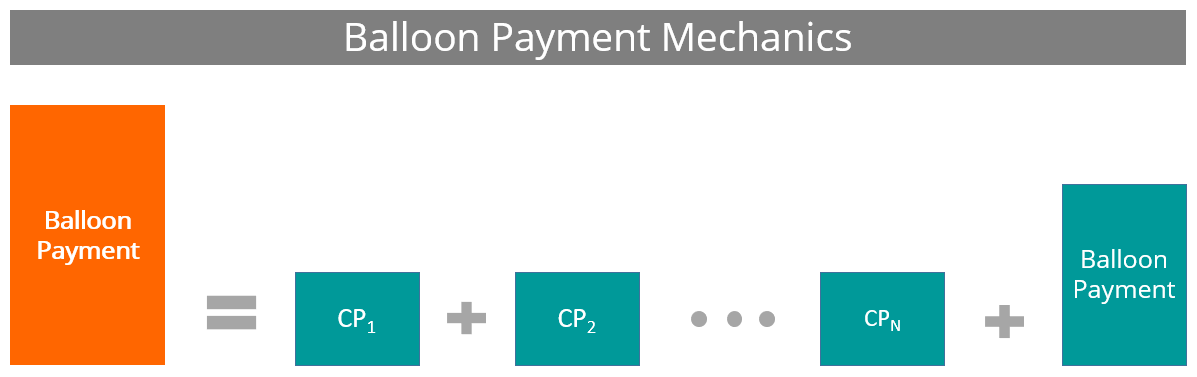

Balloon Payment Overview Application How To Calculate

Financing Fees Deferred Capitalized Amortized

Revolving Credit Facility Efinancemanagement

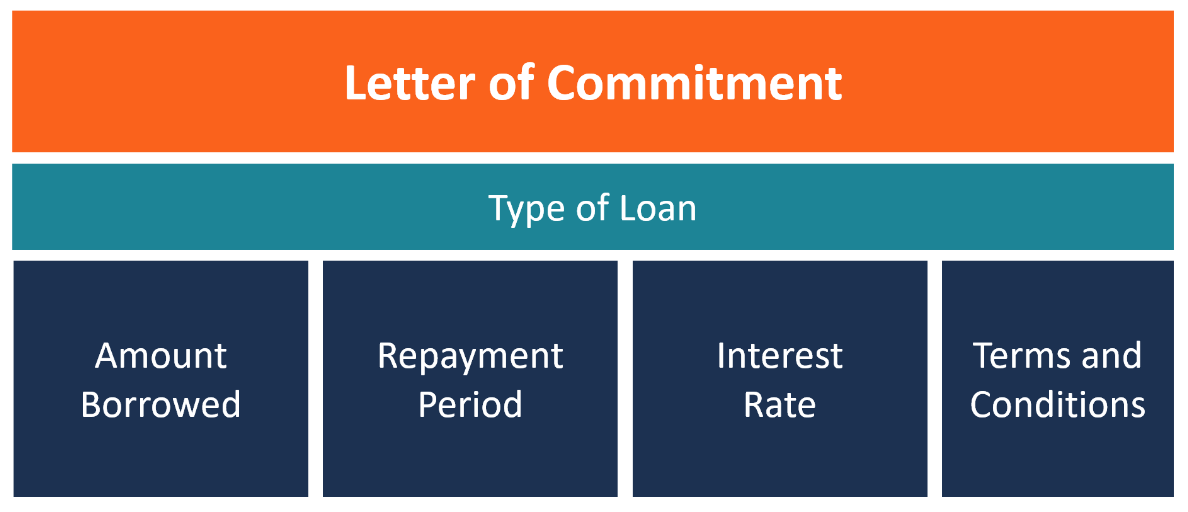

Letter Of Commitment Overview Example And Contents

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

Delayed Draw Term Loan Ddtl Overview Structure Benefits

The Benefits Of Long Term Vs Short Term Financing

Delayed Draw Term Loans Financial Edge

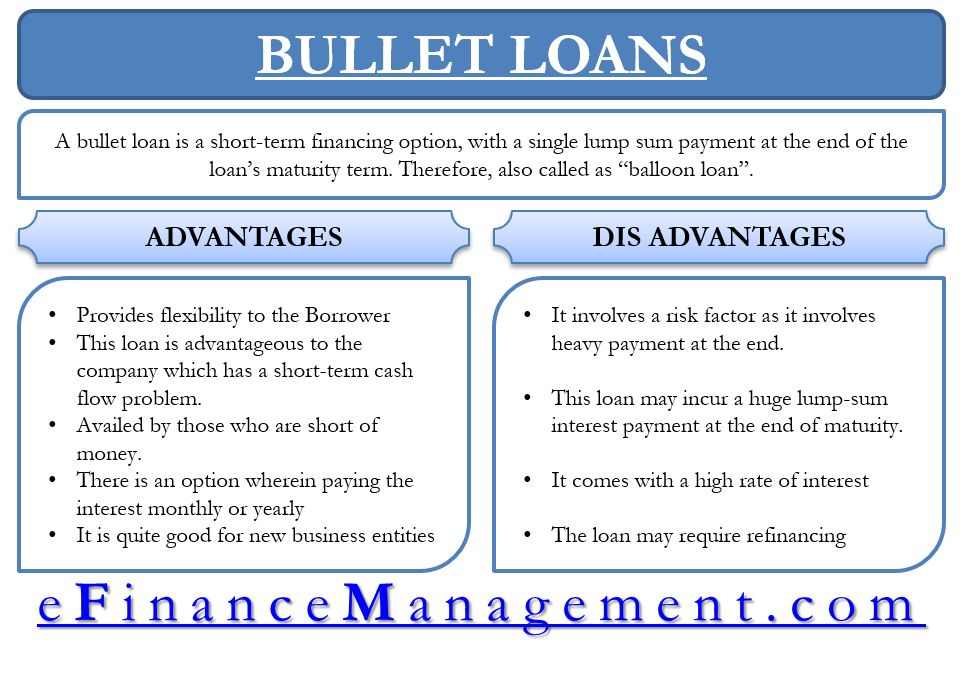

Bullet Loan Efinancemanagement

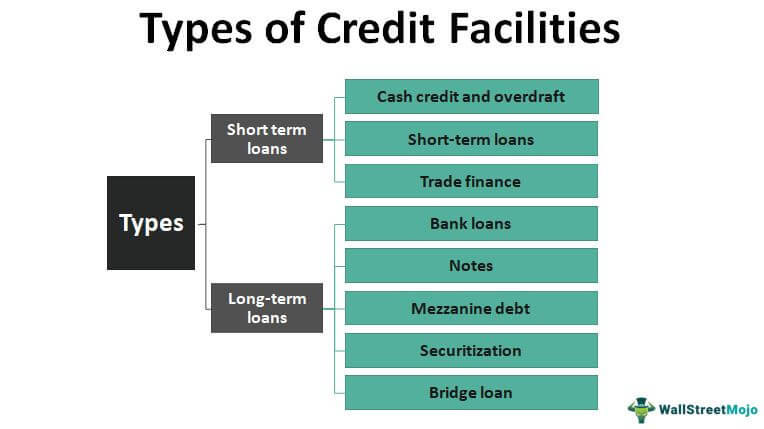

Types Of Credit Facilities Short Term And Long Term

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-grace-period-and-deferment-Final-f578b305f5764f19bce7046a690b71e0.jpg)

Grace Period Vs Deferment What S The Difference

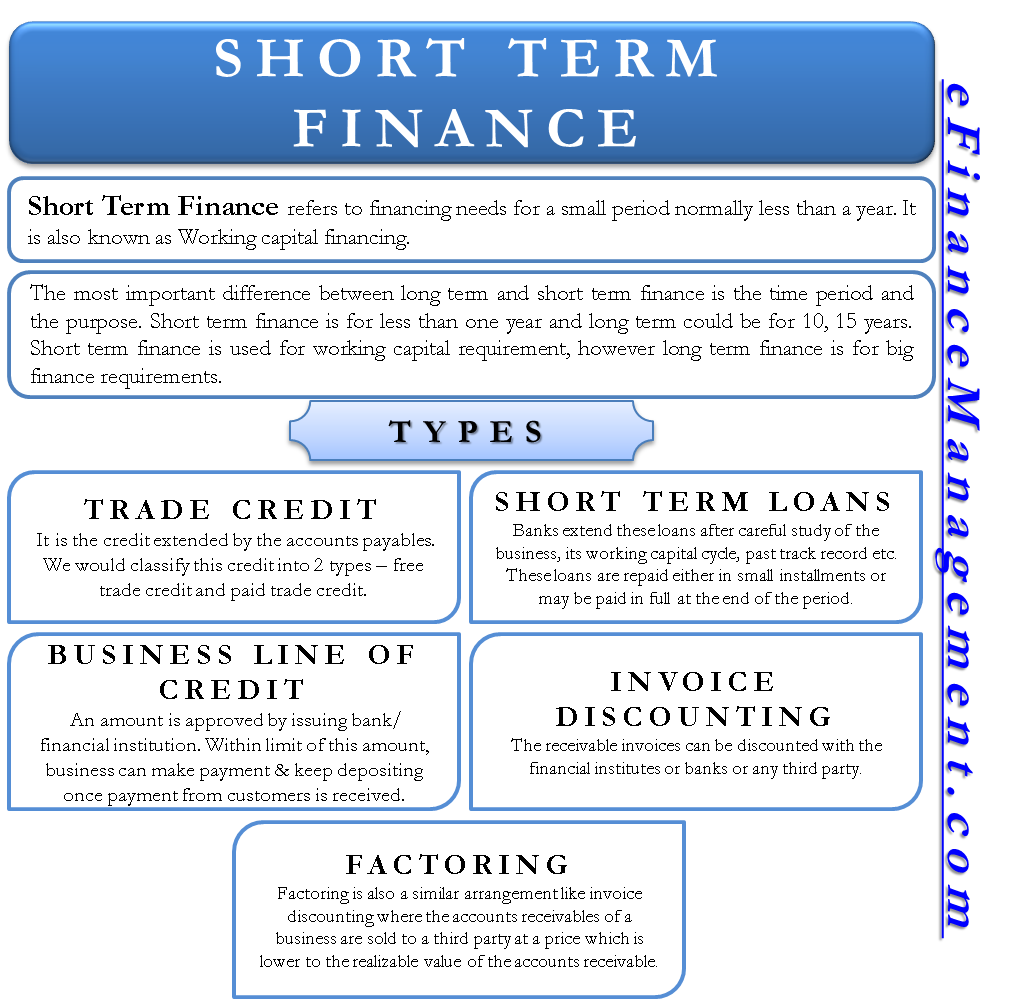

Short Term Finance Types Sources Vs Long Term Efinancemanagement